Average US Credit Card Debt Statistics

Date published: July 28, 2021

Average American debt continues to increase in most categories, but that doesn’t include credit card debt. We look at the stats to see who is most affected by this type of borrowing, including states with the most credit cards per person, number of credit cards by age, and average interest rates.

Industry Watch

How has the pandemic affected credit card debt? The answer may surprise you. Credit card debt plummeted during the first quarter of 2021. According to the Federal Reserve Bank of New York, credit card balances declined by $49 billion during early 2021. Here are some more statistics on credit card debt:

- Credit card debt is down to $807 billion so far in 2021. [Source: FRBNY]

- The average credit card balance is $5,315 in 2021. [Source: Experian]

- 15% of families report spending more money than they receive each month. [Source: Federal Reserve]

- Of the American families that spend more than they receive each month, 43% borrow and use credit cards to finance the shortfall. [Source: Federal Reserve]

- 57% of Americans use credit cards for convenience and do not carry over a balance. [Source: Federal Reserve]

Average Credit Card Interest Rates

Credit card default rates have decreased since the Great Recession, where rates were at 6.7 percent. However, only 48 percent of credit card users make the minimum payments on their cards, causing debt to roll over to the next month. This makes it more difficult to pay off their debts.

As debt grows, it is important to practice responsible spending and payment methods. Letting your debt constantly roll over into the following months is not a smart or responsible way to handle your money. Things can get out of hand quickly, and your debt will only increase. Having some debt is normal, but too much can be a financial burden for years to come if you do not practice good financial habits and do not spend your money wisely.

Request Funding Today*

By clicking "Get Started", I consent and agree to the

Privacy Policy and

Terms of Site Use.

*By filling out the form above, you will be routed to Lendza’s funding request form.

Using a credit card with a high interest rate is even riskier, so it is vital to pay off the debt before you are charged with a large interest percentage on top of your current debt. Your credit score will suffer if you do not pay off your credit card on time each month. The higher your utilization (the amount of credit you use compared to the amount of credit you have), the lower you credit score will be. The sooner you take care of your debt, the sooner you will repair your credit score and get back on track to buying a car, house, or another important purchase.

How Many Credit Cards Do Americans Have?

According to Experian Consumer Credit Review, the average American has four credit cards. If you are able to manage your credit cards, you can qualify for maximum rewards, interest-free financing, and annual statement credits. While having more than one credit card is useful, you should always watch your credit score and your finances closely, as too many credit cards can lower your score and cause you to spend more, which means more potential debt. Just applying for a credit card account can lower your credit score by five points, so it’s not always a smart move to make if you are trying to improve your credit.

Credit card debt statistics:

- Americans have an average of four credit cards

- New Jersey residents have the most credit cards, on average 4.1

- Alaska and Mississippi residents have the least amount of credit cards, on average 2.8

States with most credit cards:

- New Jersey: 4.1

- Connecticut: 3.8

- New York: 3.8

- Delaware: 3.7

- Florida: 3.7

- Rhode Island: 3.7

- Maryland: 3.6

- Texas: 3.6

- California: 3.6

- Illinois: 3.6

States with the fewest credit cards:

- Alaska: 2.8

- Mississippi: 2.8

- Oklahoma: 2.9

- Wyoming: 2.9

- Montana: 2.9

- District of Columbia: 3

- Alabama: 3

- Vermont: 3

- Arkansas:

- South Dakota: 3

Source: Lexington Law

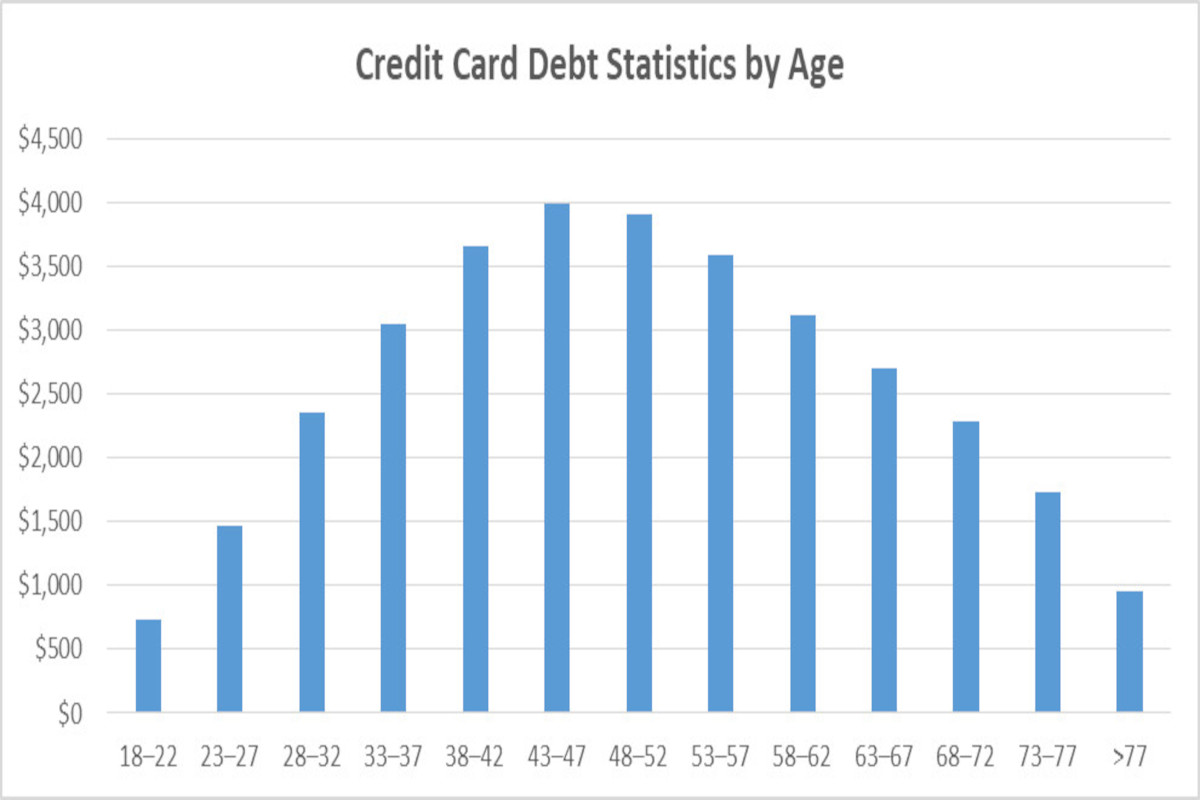

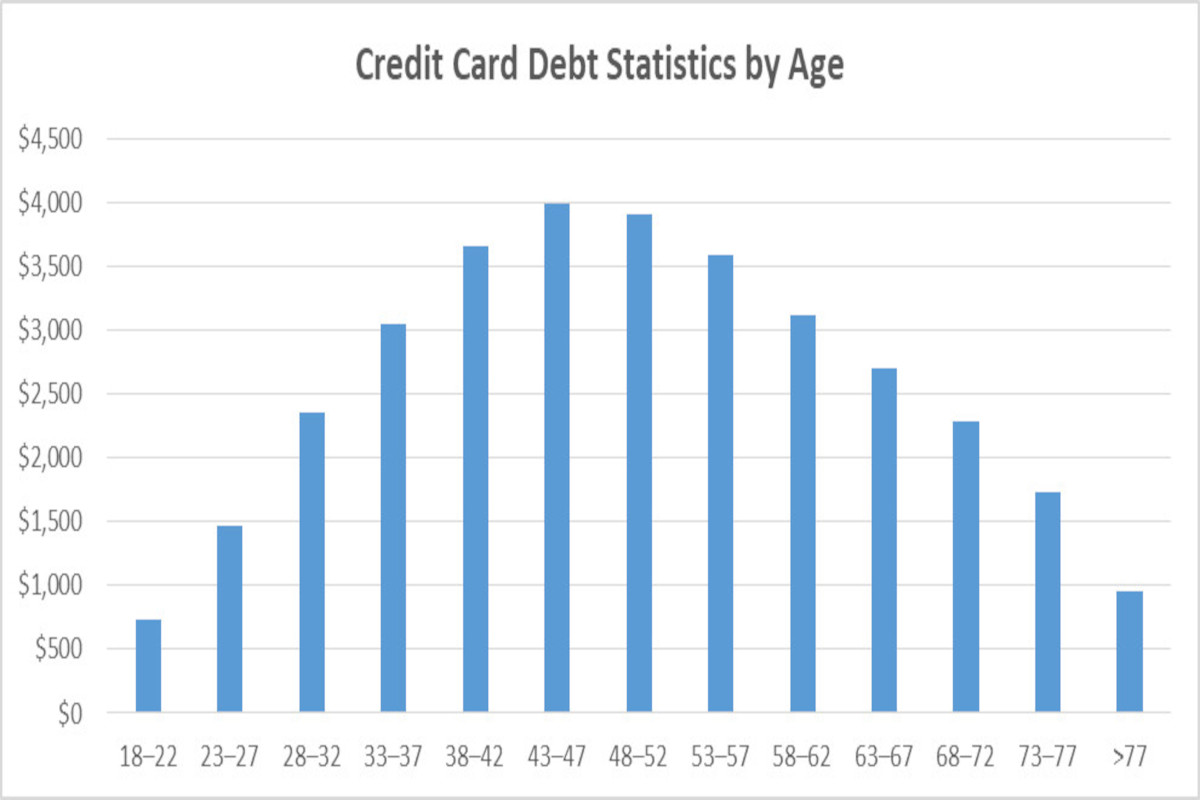

Credit Card Debt by Age

Those aged 18-22 carry the least amount of credit card debt since they are least likely to have credit cards and have the least chance of attaining a high-balance credit line. In contrast, 43-47 year olds have the highest amount of credit card debt. Read below to see the statistics on credit cards by age:

- Younger than 35: $1,900

- 35-44: $2,700

- 45-54: $3,200

- 55-64: $3,000

- 65-74: $2,850

- 75 or older: $2,700

Which Generations Have the Greatest Amount of Debt?

The data below shows that Generation X and Baby Boomers have the greatest amount of credit card debt. Since these groups tend to have a higher income, they spend more money than other generations do.

Chart: Credit Card Debt Statistics by Generation

- Generation Z: $2,047

- Generation Y: $4,315

- Generation X: $7,750

- Baby Boomers: $7,550

- Silent Generation: $4,613

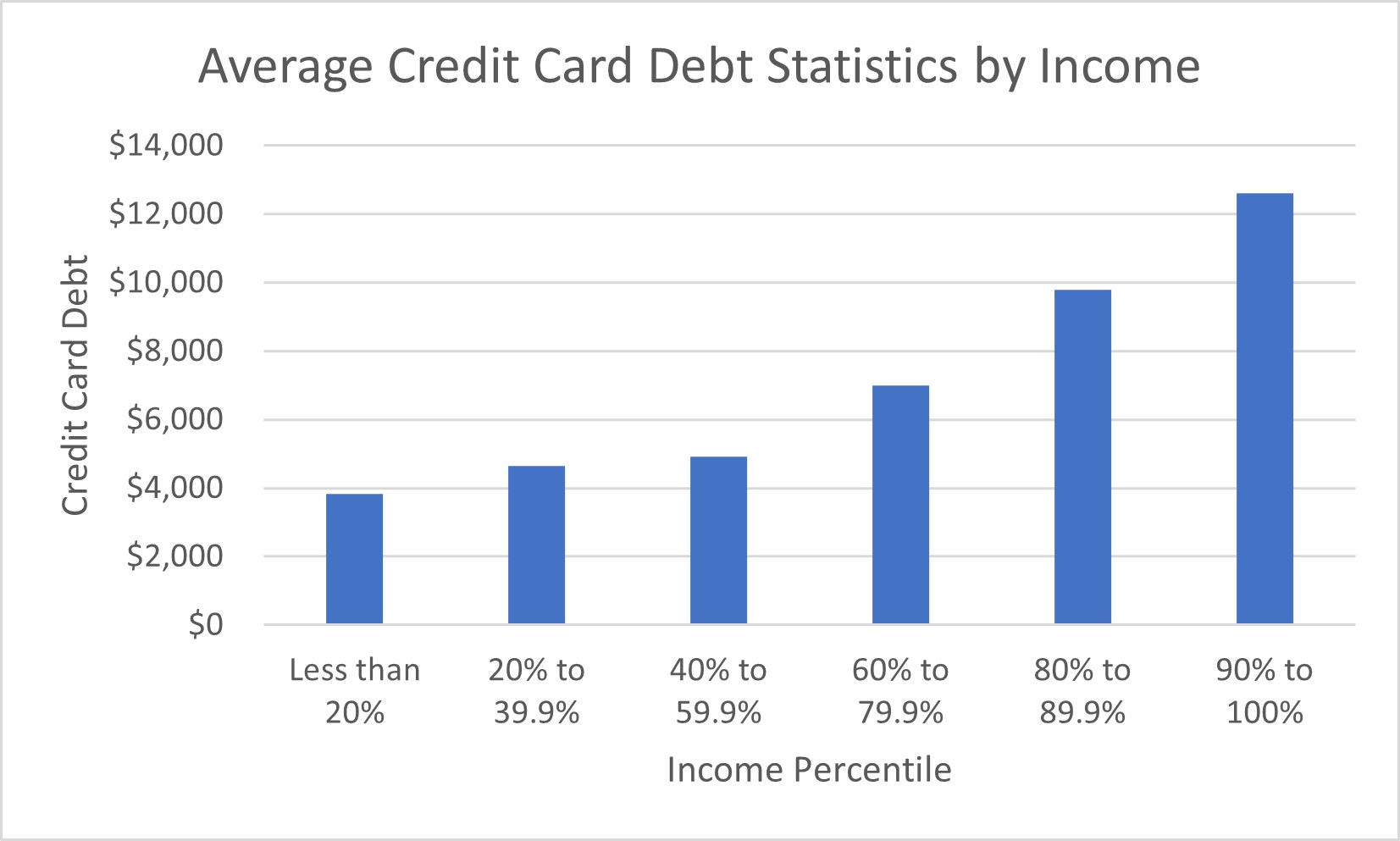

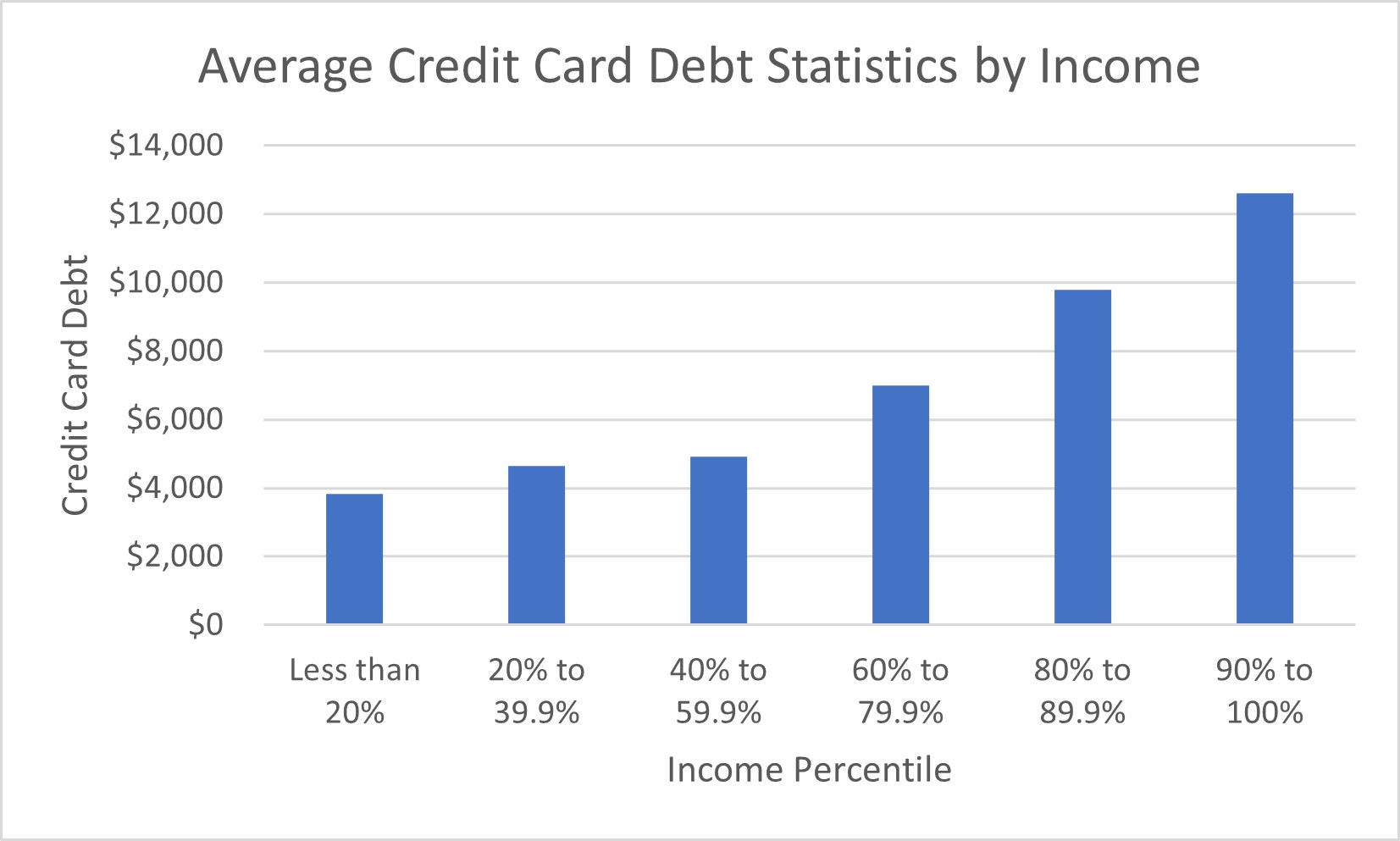

Credit Card Debt by Income

Those who make more money will likely have larger amounts of debt. That's what the data shows us in the following chart that shows the average debt amount of debt by income percentile.

Source: Lexington Law

It should be noted that while those who make more owe more, it may be easier for them to pay off their debt. High earners have usually have a lower debt-to-income ratio.

Causes of Credit Card Debt

What are some reasons why people end up in credit card debt? Careless spending and shopping can contribute to large amounts of debt, which can make it difficult to pay off in time.

- Medical bills - A trip to the hospital can cost thousands of dollars, depending on the situation. This can lead to high amounts of debt and won’t be easy to pay off immediately.

- Living expenses - Food, gas, water, dining out, shopping, etc. All these expenses add up and can burn a hole in your wallet rather quickly.

- Home and car repairs - Our cars require maintenance and regular checkups to make sure everything is running smoothly. Sometimes the issues are much more expensive than expected, and we have to take out a short term loan to cover the costs. This can lead to more bills in the future.

- Vacations - While we all need a trip every now and then, a vacation can rack up an immense amount of debt. It may take months to pay off if you do not budget wisely, either.

- Interest charges - Interest charges can build when you carry a balance on your credit cards. According to Experian, in 2019 the average American household carried $6,194 in credit card bills.

Average Household Credit Card Debt

According to Lexington Law, the average American household had racked up $6,040 in debt, and the average credit card debt had increased by 9.4% since 2014. Read below to see the statistics.

Source: Lexington Law

Credit Card Debt Settlement

Debt settlement occurs when borrowers are unable to make payments, and creditors accept a lower amount to avoid the risk of a borrower declaring bankruptcy. Consumers will need to make monthly payments to an escrow bank account until there is enough money for the debt settlement company to negotiate a deal with creditors. Consumers who go through and complete a debt settlement program reduce their debt by 45%.

More debt settlement statistics:

- The median income of consumers in debt settlement programs is 42% higher than the average American.

- Two-thirds of debt settlement participants (66%) earned more than $50,000 a year.

- The average consumer enrolled in a debt settlement was 38 years old.

- 61% of consumers in debt settlement programs have attended college.

Source: NCES

Things to Know About Your Debt

While it may seem like it is impossible to escape your debt, you should know that it is possible to never have it, if you spend your money wisely. But once you do, it can be difficult to repay it. It can also affect your credit score if you are having trouble making payments on time, which can, later on, affect your chances of buying a home or making large purchases. If you cannot repay your debt, you may need to apply for a credit card settlement. It is crucial that you keep track of your expenses so that you are not struggling in the long run.

Things to know about your debt:

- It is possible to never have debt.

The data above shows that some consumers pay off their debt each month. This makes it, so they don’t have to pay interest, which frees up cash for other things.

- Know when short-term loans are the right option.

Addressing an emergency expense may require a high-interest short-term loan. It is important to pay this money back as soon as possible. Nobody should take out a short-term loan to pay off long-term debt.

- Have a repayment plan.

If you don’t have the money for something today, and you borrow a loan for the funds, then you may find yourself not being able to pay back the loan when it is due. It is important to have a plan on how you will be able to fund your loan payments.

- Debt affects your credit score.

The amount of money you owe on your credit cards is likely affecting your credit score. If you are using most of your available credit, then your score will be lower. Likewise, if you are utilizing less of your credit line, then your score may be higher.

- Look into credit card debt settlement plans if you cannot repay your bills.

Some consumers get into trouble making a desperate decision when they owe money. It can be smarter to use a debt repair product to get your finances back on track.

- Ask for help if you cannot repay your debt.

Your friends or family may be able to help you get back on solid financial footing. Let them know what’s wrong and how they can help you meet your goals.

- Choose the right mix of credit cards.

Having a travel card for travel expenses makes sense. The same goes for swiping at the grocery store, gas station, restaurant, or anywhere else where the right card will get you more points.

At the end of the day, it is about how you manage your money and how you choose to repay your loans and debt. We often spend more than we make and fail to understand the consequences until we are charged with a massive bill we cannot pay off all at once. Paying attention to your spending habit and making smart financial decisions is the best way to ensure that you will not incur large amounts of debt and can save up for important expenses and investments for the future.

Ethan James is an experienced Financial Writer at Lendza with over a decade of experience.